Presenting Sector and Value Chain Analytics of Georgia

On May 23, PMC Research Center (PMC RC) in association with ISET Policy Institute under the USAID Georgia Economic Security Program (GESP) conducted a presentation of the final report of the project entitled “Sector and Value Chain Analytics.”

The analytical report – the sixth of its kind - provides an analysis of economic trends in 2021, as well as picking out challenges and opportunities (in local, regional, and global contexts) across selected value chains within six sectors to improve evidence-based decision-making via the provision of quality information and analytics. The specific sectors chosen are tourism, creative industries, light manufacturing, shared intellectual services, solid waste management and recycling, along with cross-cutting sectors.

The analysis of trends in travel services revealed that it had been the value chain hardest hit by the pandemic. However, it must be noted that both the accommodation and food service value chains experienced a significant recovery in 2021. As for creative industries, this sector has been markedly affected by the pandemic, while the media content production and post-production value chain has experienced contraction across all indicators and is yet to recover. The aggregate sector of information and communication technology (ICT), in contrast, has not only recovered but even partially surpassed its pre-2020 levels.

Regarding the light manufacturing sector, the analysis reveals that the turnover in all value chains demonstrated positive nominal growth in 2021 compared to 2020, with the highest growth observed in the furniture inputs value chain (52.7%). Furthermore, turnover for the solid waste management and recycling sector also increased by 44.3% (after declining by 6.6% in 2020). Last but not least, in 2021 all cross-cutting value chains experienced considerable growth, despite the loosening of pandemic-related restrictions being expected to have a negative effect on ICT and e-commerce, which might hint at the shift toward a digital economy (that was caused by the restrictions imposed in 2020) becoming permanent. However, pent-up demand in 2021 could also be a key reason behind this increase.

During the event, the Gastronomic Association of Georgia, the Georgian Tourism Association, the Georgian Heritage Crafts Association, the E-Commerce Association of Georgia, Voice of E-Commerce, the Georgian Construction Materials Cluster, the Georgian Furniture Cluster, the Waste Management Association, the Human Resources Management Professionals' Association, and the Georgian Federation of Professional Accountants and Auditors all presented the findings of the report specific to their sectors, while consultants of PMC RC and ISET moderated.

"Preparing such reports, on the one hand, strengthens the public interest in the industries, and on the other hand, with access to statistics, helps businesses to make rational and favorable decisions and, consequently, to grow,” said Tamo Gogolashvili, Head of Voice of E-Commerce.

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

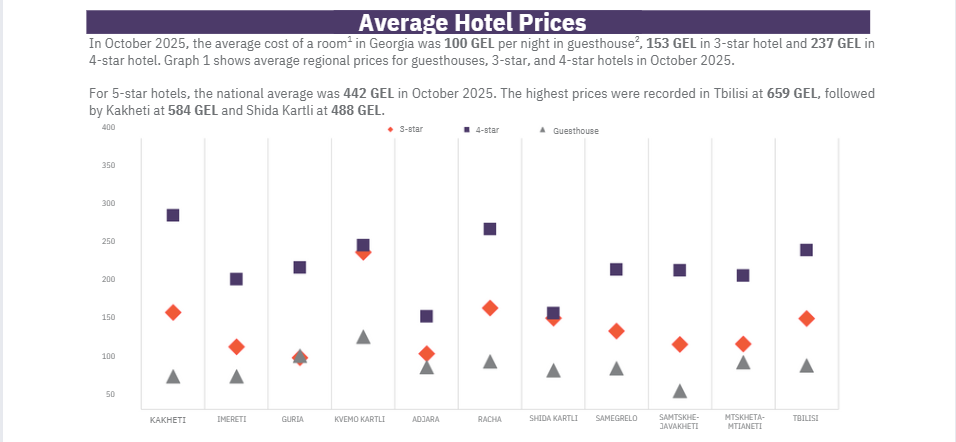

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

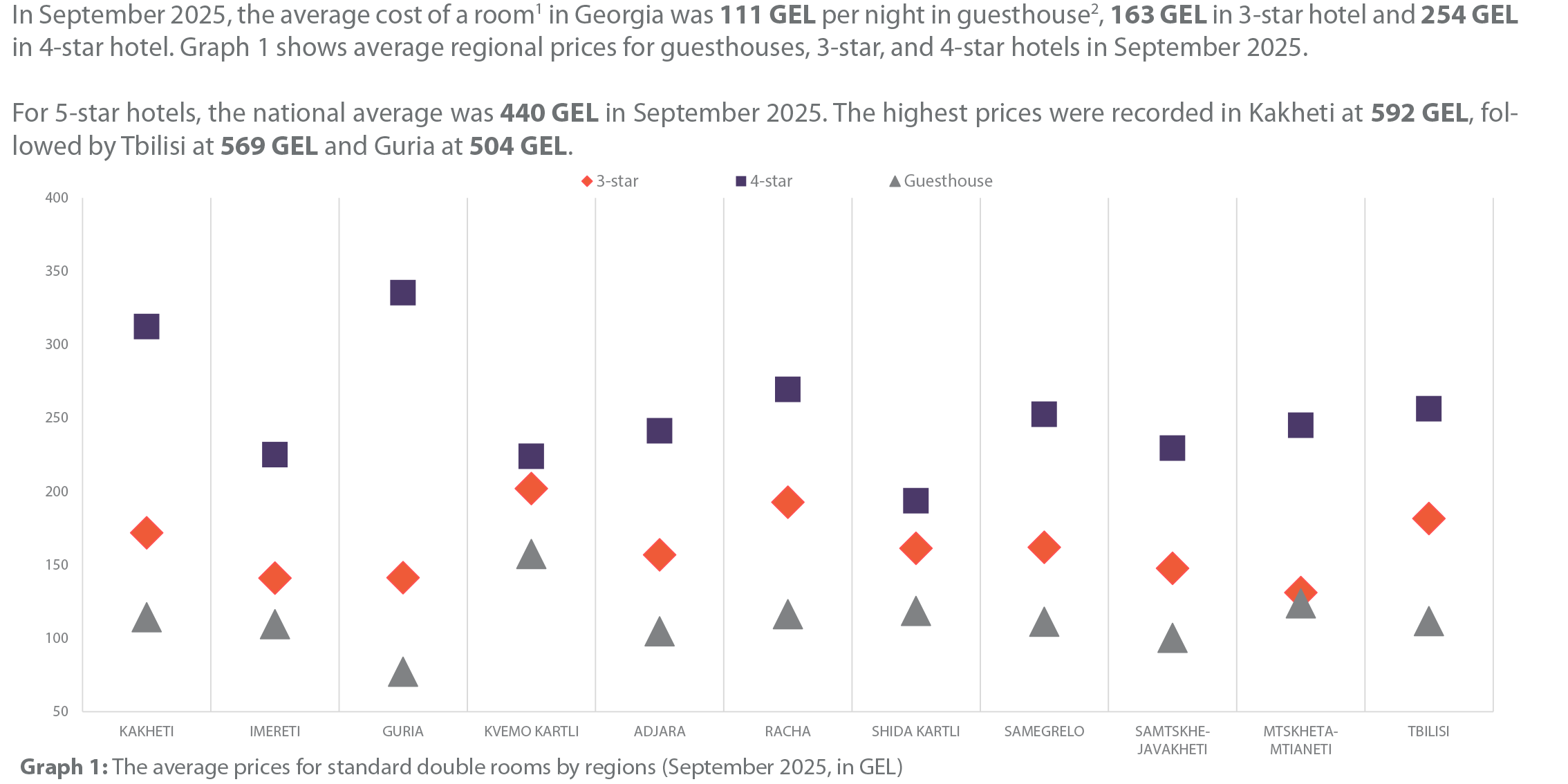

• In September 2025, hotel price index in Georgia decreased by 9.2% month-over-month (MoM), with the largest declines in Guria, Adjara and Samtskhe-Javakheti. • In September 2025, hotel price index in Georgia decreased by 1.8% year-over-year (YoY), with the largest declines in Adjara, Tbilisi and Kakheti. • The average price of a room ranged from 111 GEL to 440 GEL in September 2025.

In August 2025, the number of persons receiving a monthly salary declined by 5.7% month-over-month but rose by 2.6% year-over-year. In August 2025, the share of employees earning 2,400 GEL or more fell to 33.1%, while the share earning up to 600 GEL rose to 13.5%, month-over-month. Vacancies published on Jobs.ge decreased month-over-month by 11.0% and increased by 3.0% year-over-year.

In July 2025, the number of persons receiving a salary of 2,400 GEL or more exceeded the number of persons receiving a salary between 1,200 and 2,399 GEL. In July 2025, the highest growth in the number of vacancies on jobs.ge was recorded in IT and programming category, both month-over-month (+11.1%) and year-over-year (+26.8%). In Q2 of 2025, compared to Q1 2025, the efficiency of the labor market remained unchanged, as neither the job openings rate nor the unemployment rate showed a statistically significant change.

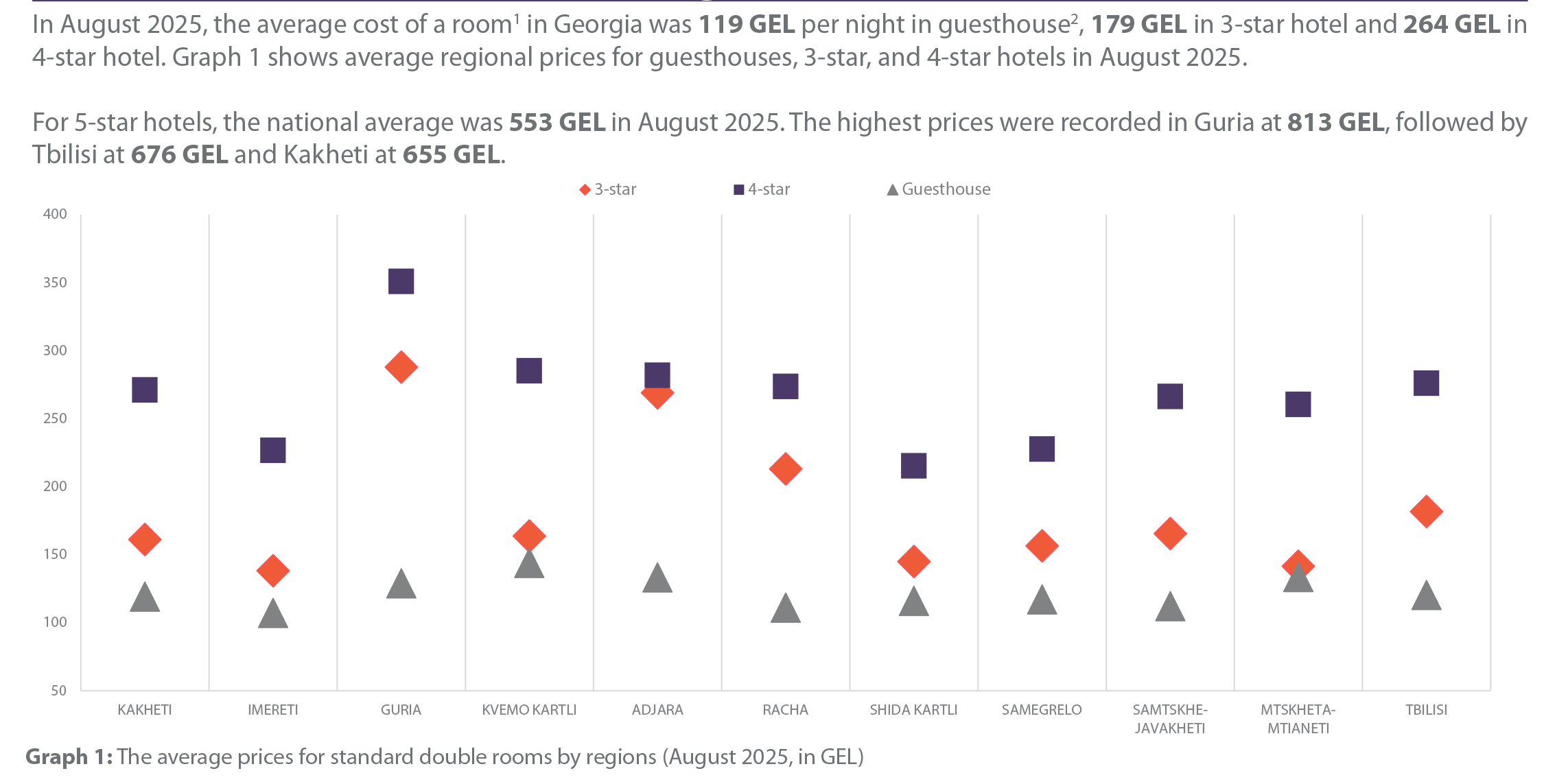

• In August 2025, hotel price index in Georgia increased by 3.5% month-over-month (MoM), with the highest growth recorded in Guria, Adjara and Racha. • In August 2025, hotel price index in Georgia increased by 1.1% year-over-year (YoY), with the highest growth recorded in Samtskhe-Javakheti, Shida Kartli and Racha. • Both MoM and YoY growth was mainly driven by rising guesthouse prices in August 2025• The average price of a room ranged from 119 GEL to 553 GEL in August 2025.

In June 2025, the number of persons receiving a monthly salary increased by 0.5% month-over-month (MoM) and by 3.4% year-over-year (YoY). In June 2025, the share of persons receiving a monthly salary of 2,400 GEL or more amounted to 32.8%, up 0.9 percentage points MoM and 6.6 percentage points YoY. In June 2025, the number of jobs published on Jobs.ge increased by 6.4% MoM but decreased by 1.0% YoY.