Contributing to the Trans European Policy Studies Association’s (TEPSA) “European Council Experts' Debrief” Publication

The PMC Research Center (PMC RC) team recently contributed to the Trans European Policy Studies Association’s (TEPSA) publication entitled “European Council Experts' Debrief,” (EUCO Debrief) which focuses on a number of important topics discussed at the European Council, such as security & defense, energy, economic issues, and the European Neighbourhood Policy (ENP).

The EUCO Debrief is a series of policy responses to the regularly-published conclusions of the European Council. Each time the European Council meets for a summit, TEPSA gathers its leading academics to comment on the conclusions, analyze the alliances formed, maintained, and broken, investigate the policy implications of the consensuses reached, and prescribe solutions to move Europe forward.

In this issue, PMC RC, specifically its researchers Elene Panchulidze and Irakli Sirbiladze, focused on the topic of the EU membership applications of Ukraine, Moldova, and Georgia, while Giorgi Tsulaia (Junior Researcher) and Anastasia Chkhenkeli (Research Assistant) discussed the EU’s sanctions imposed on Russia, as well as pondering which other sanctions the EU could apply in the future.

While the European Council has requested that the Commission examine the membership application of Ukraine, Moldova, and Georgia, Panchulidze and Sirbiladze discussed if the EU’s eastern enlargement is a genuine possibility and what the potential geopolitical consequences could be thereof. They also focused on how this could affect its relations with long-standing candidate members, such as those in the Balkans.

“Looking to the future, one possible scenario for the EU is to adopt the Western Balkans toolkit vis-à-vis the three associated states and grant them ‘potential candidate’ status. This would mean the acknowledgement of a clear European perspective, but also sending a signal to the associated partners that candidate status and eventual membership are only possible when EU values are actually shared by those countries. To progress to the next stage, the EU fundamentals of the rule of law, functioning democratic institutions, public administration, and economic reforms must be upheld with the association process still the common framework for relations. While there is no fast-track procedure defined in the treaties, the EU can nevertheless show some flexibility and consider the model of staged accession in response to the ongoing geopolitical developments and the growing number of states in the membership “waiting room”,” noted the authors in their contribution.

As the EU remains ready to close loopholes and target actual and possible circumvention, as well as to move quickly with further sanctions, Tsulaia and Chkhenkeli focused their discussion regarding the EU’s sanctions imposed against Russia on the overview of existing loopholes therein and propose further forms of sanctions.

“While imposing full-scale energy sanctions and fully banning energy imports from Russia to the EU is debatable due to the EU’s high dependency on Russian oil and gas, there is a possibility to strengthen the already-imposed sanctions by lifting energy-related exemptions."

“The decision of whether to expand or not, and in which directions to do so, depends on the exact objective of those sanctions. Since the first sanctions were triggered, they have considerably damaged Russia’s economy and its international reputation. The continuing effectiveness of the sanctions thus depends on the strategy behind them. The imposition of sanctions should thus take into consideration whether this strategy is designed to exhaust the Russian economy so much that it would no longer be able to support the war effort, and whether they will shift public opinion in Russia against its government, or just punish Russia and its citizens without any room for reversibility,” observed Tsulaia and Chkhenkeli.

To read the full paper, please follow the link: “European Council Experts' Debrief”

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

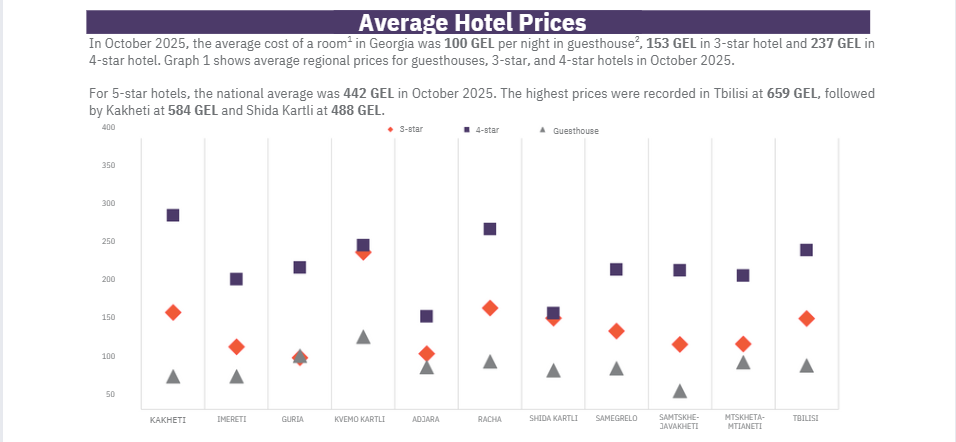

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

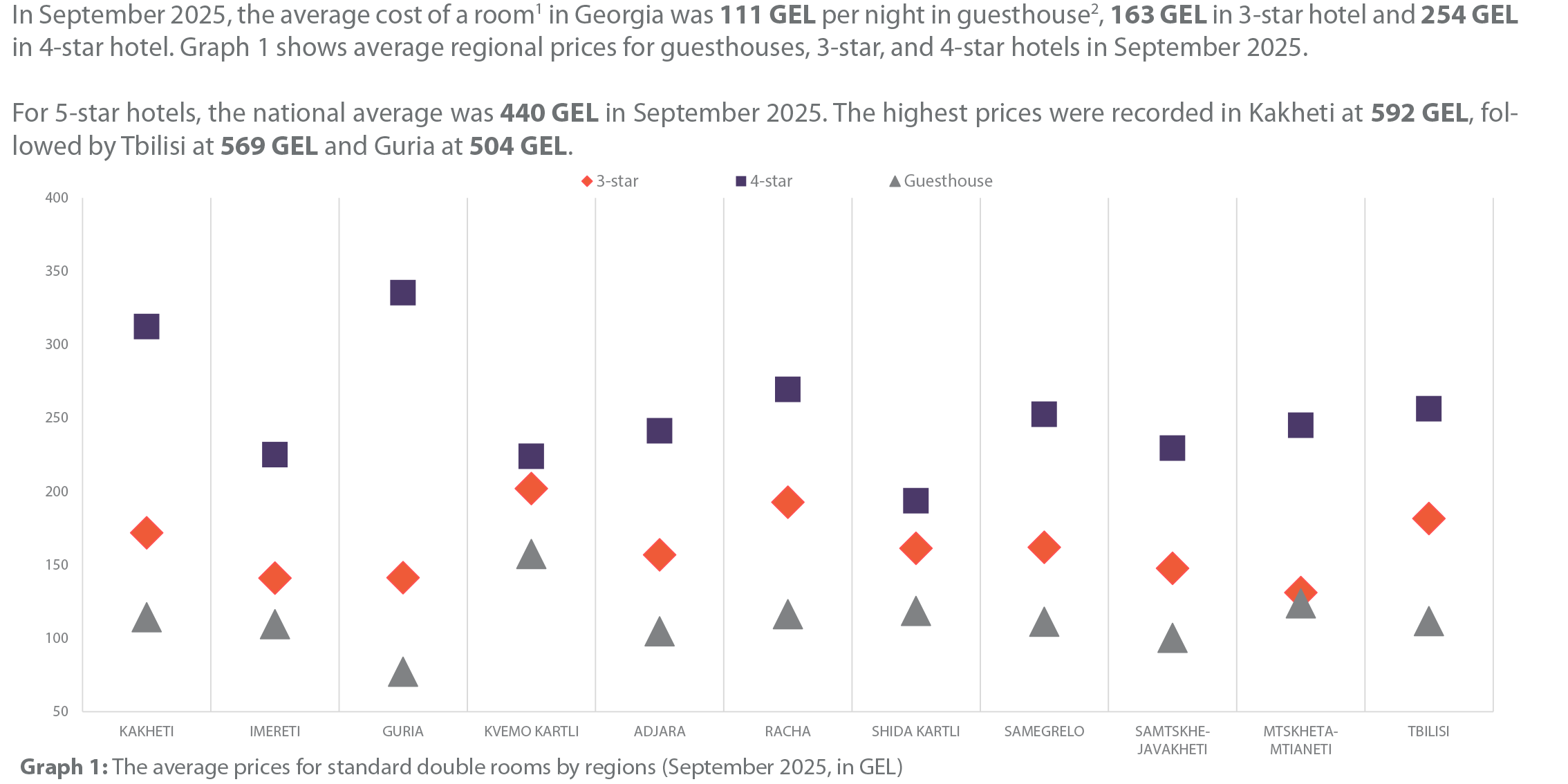

• In September 2025, hotel price index in Georgia decreased by 9.2% month-over-month (MoM), with the largest declines in Guria, Adjara and Samtskhe-Javakheti. • In September 2025, hotel price index in Georgia decreased by 1.8% year-over-year (YoY), with the largest declines in Adjara, Tbilisi and Kakheti. • The average price of a room ranged from 111 GEL to 440 GEL in September 2025.

In August 2025, the number of persons receiving a monthly salary declined by 5.7% month-over-month but rose by 2.6% year-over-year. In August 2025, the share of employees earning 2,400 GEL or more fell to 33.1%, while the share earning up to 600 GEL rose to 13.5%, month-over-month. Vacancies published on Jobs.ge decreased month-over-month by 11.0% and increased by 3.0% year-over-year.

In July 2025, the number of persons receiving a salary of 2,400 GEL or more exceeded the number of persons receiving a salary between 1,200 and 2,399 GEL. In July 2025, the highest growth in the number of vacancies on jobs.ge was recorded in IT and programming category, both month-over-month (+11.1%) and year-over-year (+26.8%). In Q2 of 2025, compared to Q1 2025, the efficiency of the labor market remained unchanged, as neither the job openings rate nor the unemployment rate showed a statistically significant change.

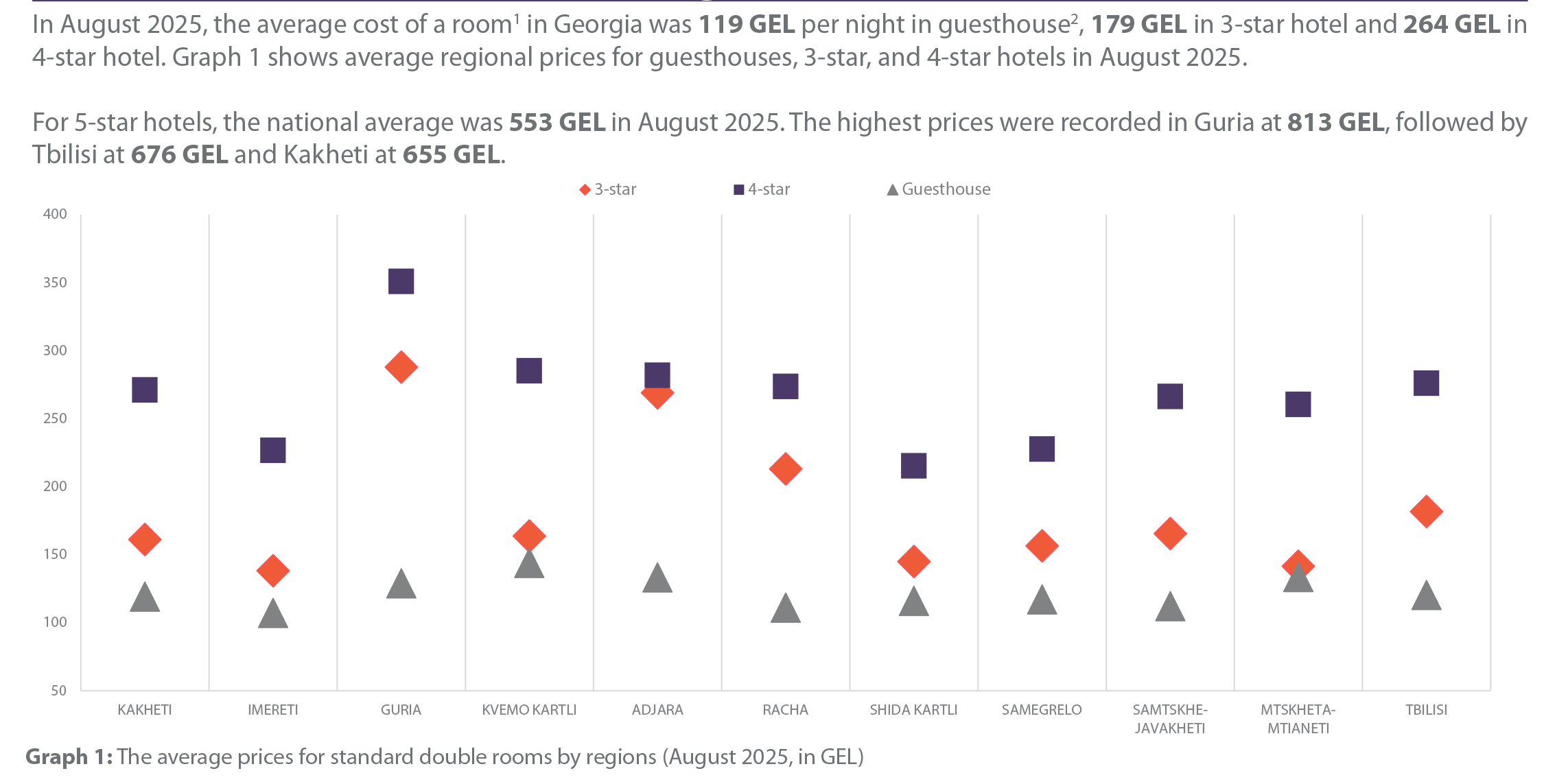

• In August 2025, hotel price index in Georgia increased by 3.5% month-over-month (MoM), with the highest growth recorded in Guria, Adjara and Racha. • In August 2025, hotel price index in Georgia increased by 1.1% year-over-year (YoY), with the highest growth recorded in Samtskhe-Javakheti, Shida Kartli and Racha. • Both MoM and YoY growth was mainly driven by rising guesthouse prices in August 2025• The average price of a room ranged from 119 GEL to 553 GEL in August 2025.

In June 2025, the number of persons receiving a monthly salary increased by 0.5% month-over-month (MoM) and by 3.4% year-over-year (YoY). In June 2025, the share of persons receiving a monthly salary of 2,400 GEL or more amounted to 32.8%, up 0.9 percentage points MoM and 6.6 percentage points YoY. In June 2025, the number of jobs published on Jobs.ge increased by 6.4% MoM but decreased by 1.0% YoY.