The EBRD and its Donors Helping us to Grow: Using Mr. Thomas Wittig’s Expertise to Expand and Drive Forward

In achieving our strategic expansion initiatives with regard to geographical coverage, sectors, and products, we believe that it is essential to enhance our organizational capacity continuously. With this in mind, courtesy of the financial support of the European Bank for Reconstruction and Development (EBRD) and the Small Business Impact Fund (Italy, Japan, Luxembourg, Norway, Sweden, Switzerland, South Korea, TaiwanBusiness – EBRD Technical Cooperation Fund, and the USA) we are delighted to welcome to PMCG as a senior industry adviser, Mr. Thomas Wittig, Founder and CEO at WITTIGONIA.

Together with Mr. Wittig, we are working to boost our commercial growth further through advancing the company’s strategy, optimizing our marketing and communications (especially digital tools and channels of interaction with existing and potential clients, partners, beneficiaries, and consultants), advertising the company’s intellectual products, improving our international media outreach, and strengthening internal capabilities. In the course of his 30 years of professional working experience, Mr. Wittig has held senior executive and C-level positions at well-known enterprises and institutions, including Microsoft Corporation, SAP SE, and other high-growth companies. He also served as the Head Coach for Startup, Scaleup and Entrepreneurship at the Swiss Federal Commission for Technology and Innovation (now InnoSuisse).

Mr. Wittig has sound experience in strategy development and operational optimization and execution, including digital transformation, innovative solutions, data-driven sales and marketing, company building, international growth strategies, operational strategy development, optimization and streamlining of systems and processes, product development, and business modeling and simulation of performance scenarios.

From 1990 to 2005, he worked for Microsoft Corporation, where in his last five years he held the position of Global Director of the Enterprise Platform, Partner Services and Global Service Operations. At SAP SE, as a Senior Vice President and Member of the Senior Global Executive Team (2005–2009), he led the development of a small- and medium-sized enterprise (SME) solutions and partner ecosystem. Since 2014, as the founder and CEO of WITTIGONIA (based in Zurich, Switzerland), he has been working as an independent advisor for enterprises, well-known brands, and international institutions.

Meanwhile, he also teaches as an Adjunct Lecturer for Business and Organization Dynamics at the Baden-Wuerttemberg Cooperative State University (DHBW), where he covers system dynamics modeling, business dynamics, and digitalization. Through his company WITTIGONIA, he provides engaging learning experiences for individuals and organizations alike, with a focus on system leadership skills development. Mr. Wittig holds degrees from TUM Technical University of Munich, Worcester Polytechnic Institute, USA, and UEJM Brussels and executive education from Wharton and INSEAD.

We extend our gratitude to the EBRD and its donors for this and previous assistance, which has included conducting company rebranding, building proper communication channels, developing a user-friendly webpage, and enhancing our institutional capacity overall.

Our devotion to continuous development brings tangible outcomes for the company. PMCG was founded in 2007 in Georgia, while in 2013 we established an office in Washington D.C., and last year we officially registered PMCG and PMC Research Center in Ukraine. Throughout its history, PMCG has shared its experience and expertise across a range of different services (policy advising, institutional development and capacity building, monitoring and evaluation, infrastructure development, and corporate development and consulting) to a total of 32 nations across the globe. Our contribution in developing countries’ policies and their implementation of reforms has enabled thousands of people to enhance their wellbeing and overall quality of life. This has ranged from revenue generation in Africa to enhancing fiscal efficiency and regulatory frameworks in Europe and Central Asia. The success we have achieved has been driven by our dedication to blending our knowledge and international best practices, combined with tapping into local expertise in every nation in which we work. Our complex approach ensures that the policies we put together are carefully designed and ideally suited to overcome obstacles and grasp opportunities presented.

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

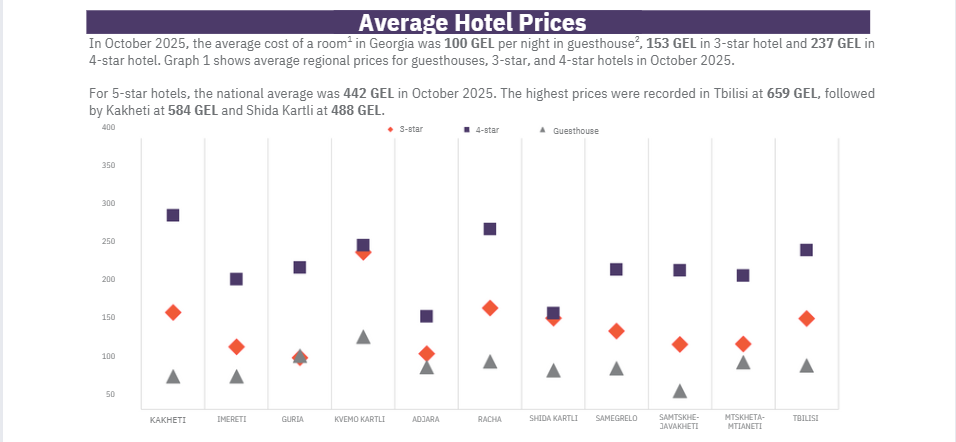

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

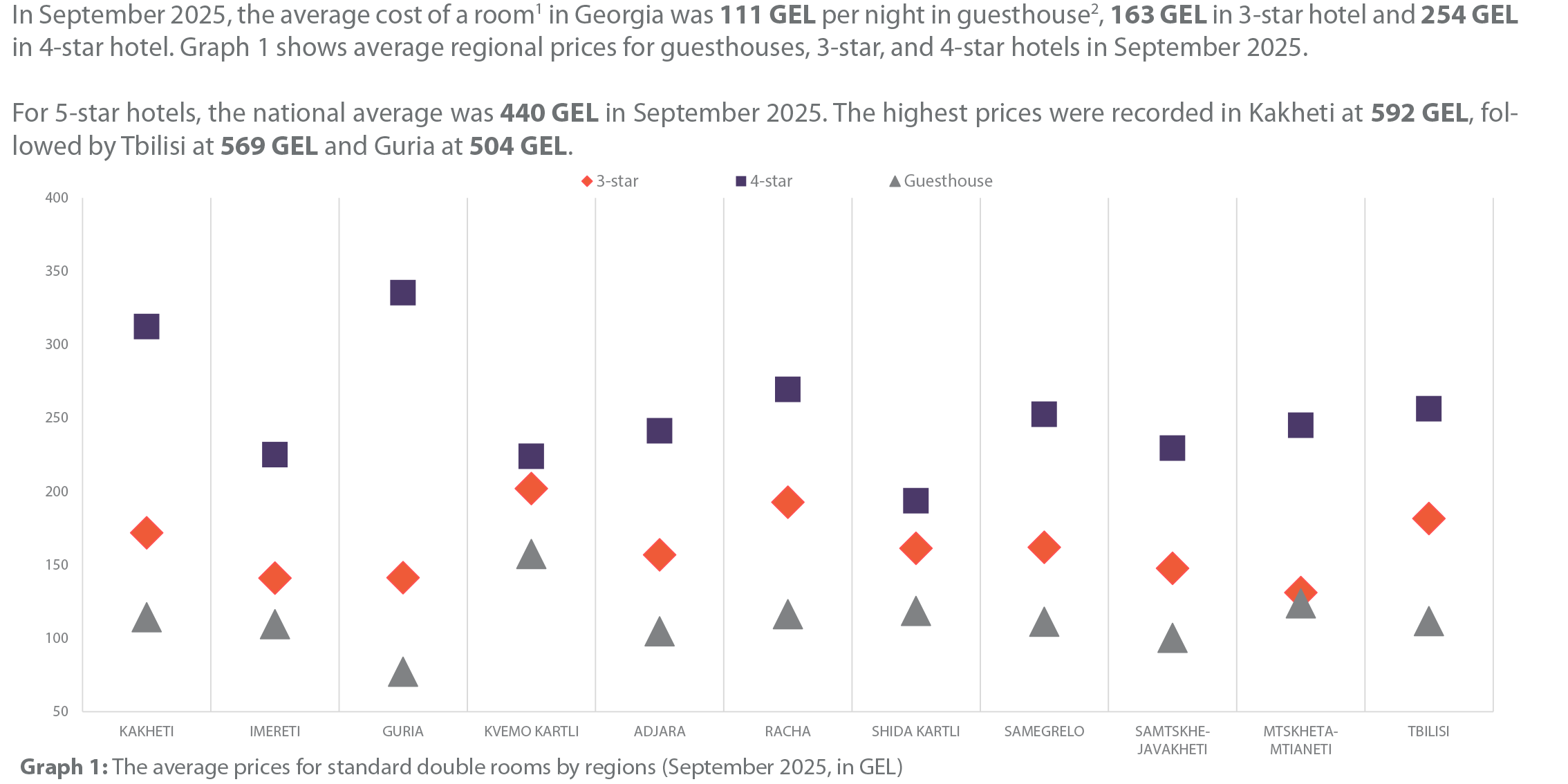

• In September 2025, hotel price index in Georgia decreased by 9.2% month-over-month (MoM), with the largest declines in Guria, Adjara and Samtskhe-Javakheti. • In September 2025, hotel price index in Georgia decreased by 1.8% year-over-year (YoY), with the largest declines in Adjara, Tbilisi and Kakheti. • The average price of a room ranged from 111 GEL to 440 GEL in September 2025.

In August 2025, the number of persons receiving a monthly salary declined by 5.7% month-over-month but rose by 2.6% year-over-year. In August 2025, the share of employees earning 2,400 GEL or more fell to 33.1%, while the share earning up to 600 GEL rose to 13.5%, month-over-month. Vacancies published on Jobs.ge decreased month-over-month by 11.0% and increased by 3.0% year-over-year.

In July 2025, the number of persons receiving a salary of 2,400 GEL or more exceeded the number of persons receiving a salary between 1,200 and 2,399 GEL. In July 2025, the highest growth in the number of vacancies on jobs.ge was recorded in IT and programming category, both month-over-month (+11.1%) and year-over-year (+26.8%). In Q2 of 2025, compared to Q1 2025, the efficiency of the labor market remained unchanged, as neither the job openings rate nor the unemployment rate showed a statistically significant change.

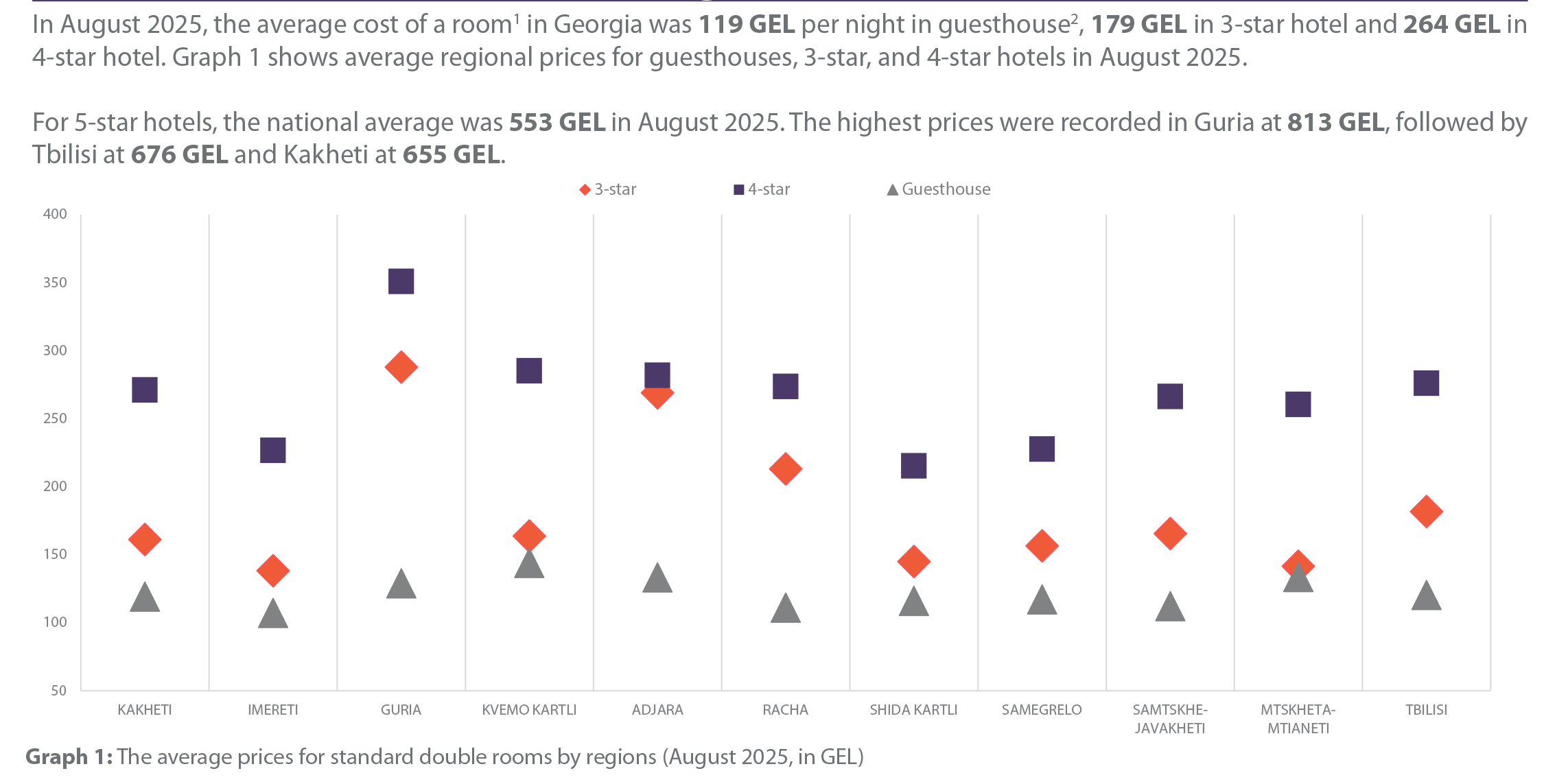

• In August 2025, hotel price index in Georgia increased by 3.5% month-over-month (MoM), with the highest growth recorded in Guria, Adjara and Racha. • In August 2025, hotel price index in Georgia increased by 1.1% year-over-year (YoY), with the highest growth recorded in Samtskhe-Javakheti, Shida Kartli and Racha. • Both MoM and YoY growth was mainly driven by rising guesthouse prices in August 2025• The average price of a room ranged from 119 GEL to 553 GEL in August 2025.

In June 2025, the number of persons receiving a monthly salary increased by 0.5% month-over-month (MoM) and by 3.4% year-over-year (YoY). In June 2025, the share of persons receiving a monthly salary of 2,400 GEL or more amounted to 32.8%, up 0.9 percentage points MoM and 6.6 percentage points YoY. In June 2025, the number of jobs published on Jobs.ge increased by 6.4% MoM but decreased by 1.0% YoY.