Supporting Georgia and Moldova Effectively Manage EU Integration Process

We recently hosted a high-level two-day knowledge-sharing workshop in Tbilisi with the support of the International Visegrad Fund. The aim of the event was to establish a platform for dialogue and assist Georgian and Moldovan businesses and governments to discuss the potential costs and benefits of the EU integration process. PMCG invited high-level practitioners and business sector representatives from Poland, Hungary, Slovakia and Czech Republic to hear about their experiences and perspectives in this regard. We particularly focused on the Deep and Comprehensive Free Trade Agreement - DCFTA - which represents the most challenging part of the Association Agreement for Georgia and Moldova.

The Georgian and Moldovan governments have agreed to harmonize their legislation with that of the Single European Market which requires approximation of various rules and standards. Georgia and Moldova will largely benefit from the DCFTA, although dialogue between public and private sectors is crucial to ensure the efficient and timely implementation of the agreement. SMEs represent one of the most vulnerable groups in this process as they have to adapt to a new environment and have to adopt standards in accordance with those of the EU. This will be beneficial from long-term perspective but can be costly if not carefully analyzed and considered. This challenge spawned the idea to invite recent EU members, the Visegrad countries, to our event in order to share their best practices, positive and negative negative experiences and lessons learnt.

To summarize the results of the workshop, we can say that Georgia and Moldova have to focus on three key areas in order to fully benefit from the DCFTA:

- Delays in the implementation process have to be prevented. Experience shows that some pieces of legislation are adopted in a hurried manner without proper consultation and engagement with the private sector which later causes undesired results and negative effects on businesses. Therefore, public and private sectors have to coordinate constantly to adopt legislation suitable and relevant to the current business climate.

- Strengthen knowledge and awareness of EU law approximation process. It is often considered that Georgia and/or Moldova have to copy EU member states’ legislation and completely re-write their respective national laws. This is an incorrect understanding, as in reality, the EU member states have different national legislation in each sector but it is compliant with EU general principles and directives. Therefore, there is a need to empower public and private sectors’ capacities in EU approximation processes in order to ensure legal harmonization which will prevent any misinterpretation and negatives impacts.

- Prevent overregulation. While harmonization regulations it is essential to consider local trends and the business climate. Overregulating of any sector, without proper analysis of the needs, might harm business development in the country and moreover bankrupt SMEs that play a crucial role in countries’ economic and sustainable development.

While considering Slovakia’s example we can see that recent liberal economic reforms in this country resulted in fast development and modernization of industries. For example, currently Slovakia is one of the front runners in the automotive industry. In contrast, the example of Czech Republic showed that a lack of proper public-private dialogue decreased confidence of businesses and the country could not fully embed free market principles. When it comes to Poland, it has to be mentioned that frequent law changes and excessive regulations have become the main obstacles for SMEs in its EU integration process whereas Hungary’s experience demonstrated the need to support SMEs to be competitive on a new market.

The following participants shared their views on the event and the broader issue of the path of EU integration for Georgia and Moldova.

“We are thankful to the Visegrad Group, which is the most consistent supporter of Georgia’s European integration course. We highly value their support, especially by sharing the experience in the process of modernization and Europeanization of Georgia through the Association Agreement” – David Bakradze, State Minister for European and Euro Atlantic Integration,

“From our experience we would highly encourage/recommend intensive formal and informal dialog and communication between government and public in general including dialog with representatives of employers, employees, NGOs and others” – Ivan Miklos, former Vice Prime Minister and Minister of Finance of Slovakia.

"The EU Association Agreement offers the opportunity to have a transformative impact on the Georgian economy…it is essential that the implementation of this agreement does not have the unintended effect of making it harder to do business in Georgia. Knowledge sharing with other countries provide essential insights about the problems to look out for, and how to proactively engage with the government in order to avoid them” – George Welton, President of Amcham in Georgia.

It was widely acknowledged during the workshop that Georgia is a front runner among EaP Countries when it comes to economic and business enabling reforms. PMCG is actively involved in the EU approximation agenda of EaP countries and is sharing its expertise and successful institutional reforms in the region. Follow-up events will be held in Chisinau, Moldova, on October 21-23, 2015 as well as in Minsk, Belarus on October 24-26.

The workshops are held under the International Visegrad Fund project “Sharing Experience of Public-Private Dialogue in EU Integration Process for Moldova and Georgia”, implemented by PMCG.

Follow the link below for detailed information about the project:

Sharing Experience of Public-Private Dialogue in EU Integration Process for Moldova and Georgia

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

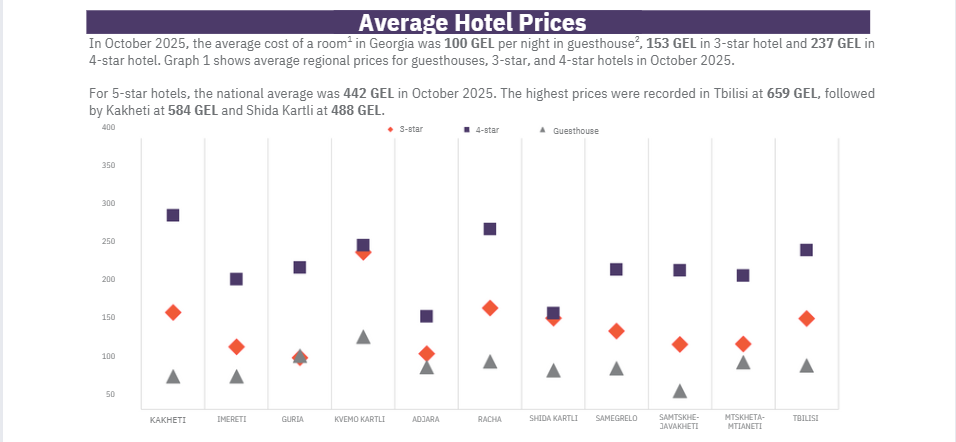

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

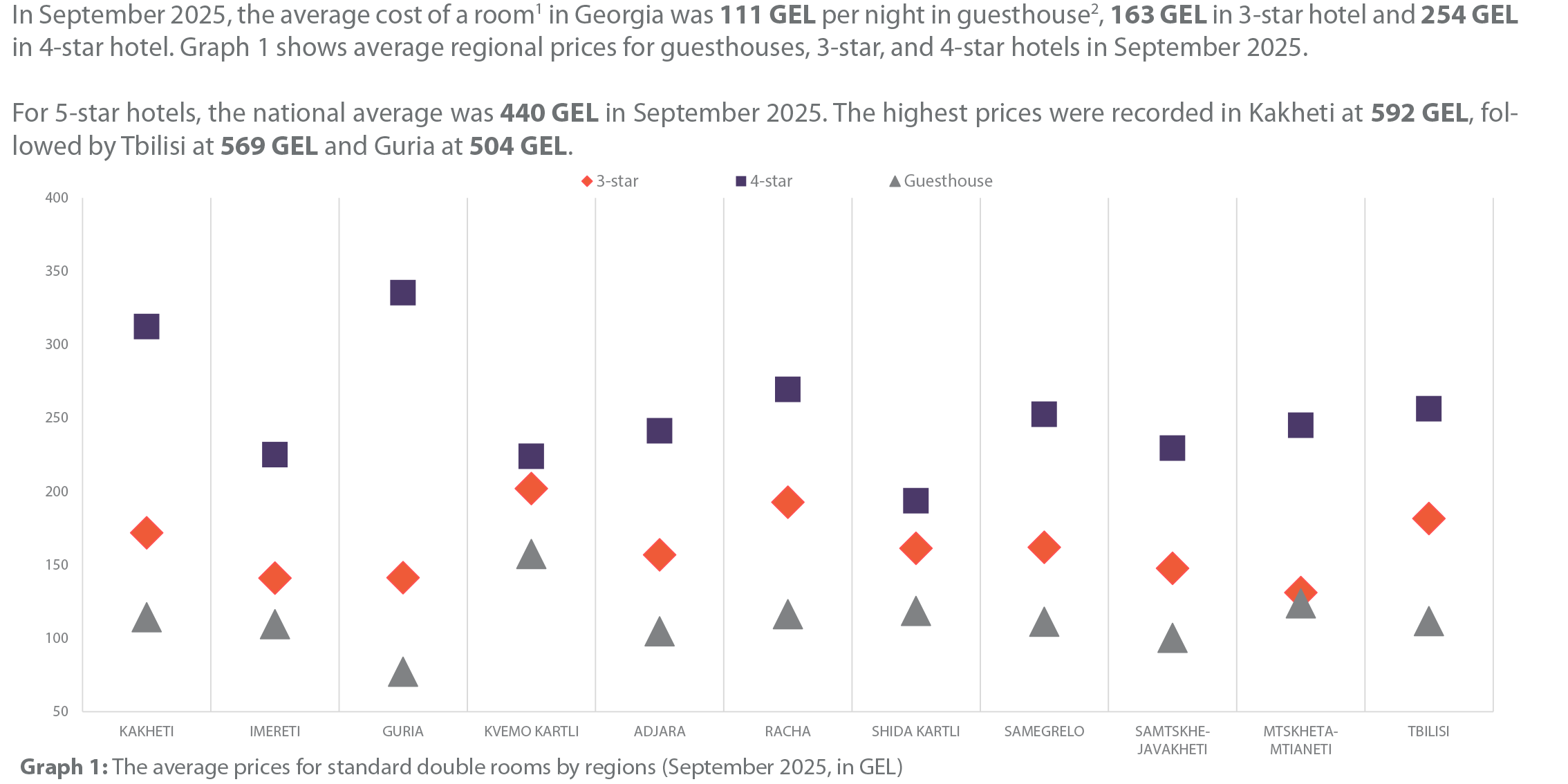

• In September 2025, hotel price index in Georgia decreased by 9.2% month-over-month (MoM), with the largest declines in Guria, Adjara and Samtskhe-Javakheti. • In September 2025, hotel price index in Georgia decreased by 1.8% year-over-year (YoY), with the largest declines in Adjara, Tbilisi and Kakheti. • The average price of a room ranged from 111 GEL to 440 GEL in September 2025.

In August 2025, the number of persons receiving a monthly salary declined by 5.7% month-over-month but rose by 2.6% year-over-year. In August 2025, the share of employees earning 2,400 GEL or more fell to 33.1%, while the share earning up to 600 GEL rose to 13.5%, month-over-month. Vacancies published on Jobs.ge decreased month-over-month by 11.0% and increased by 3.0% year-over-year.

In July 2025, the number of persons receiving a salary of 2,400 GEL or more exceeded the number of persons receiving a salary between 1,200 and 2,399 GEL. In July 2025, the highest growth in the number of vacancies on jobs.ge was recorded in IT and programming category, both month-over-month (+11.1%) and year-over-year (+26.8%). In Q2 of 2025, compared to Q1 2025, the efficiency of the labor market remained unchanged, as neither the job openings rate nor the unemployment rate showed a statistically significant change.

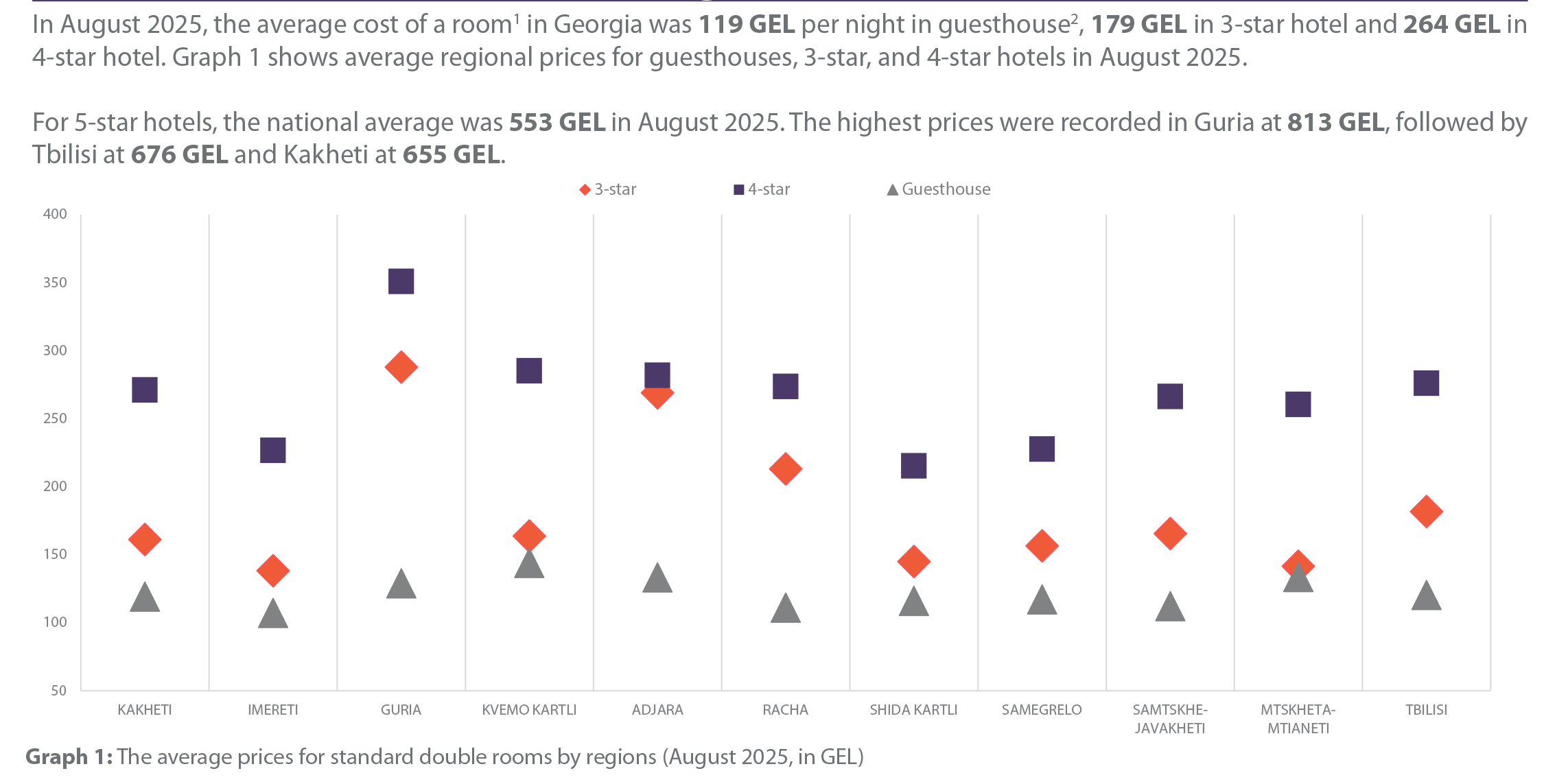

• In August 2025, hotel price index in Georgia increased by 3.5% month-over-month (MoM), with the highest growth recorded in Guria, Adjara and Racha. • In August 2025, hotel price index in Georgia increased by 1.1% year-over-year (YoY), with the highest growth recorded in Samtskhe-Javakheti, Shida Kartli and Racha. • Both MoM and YoY growth was mainly driven by rising guesthouse prices in August 2025• The average price of a room ranged from 119 GEL to 553 GEL in August 2025.

In June 2025, the number of persons receiving a monthly salary increased by 0.5% month-over-month (MoM) and by 3.4% year-over-year (YoY). In June 2025, the share of persons receiving a monthly salary of 2,400 GEL or more amounted to 32.8%, up 0.9 percentage points MoM and 6.6 percentage points YoY. In June 2025, the number of jobs published on Jobs.ge increased by 6.4% MoM but decreased by 1.0% YoY.