Projects

Mayors for Economic Growth

Project Description:

The objective of the project Mayors for Economic Growth (M4EG) is to support the local authorities (LAs) in the Eastern Partnership (EaP) countries to become active facilitators for economic growth and job creation. The project will encourage and support LAs in EaP countries to design and implement Local Economic Development Plans (LEDPs) and strengthen the technical skills and capacities of LAs to implement economic strategies in line with the principles of good governance and sound financial management.

The project team will conduct the following activities:

- Develop a content-wise concept of M4EG (including methodology for establishing the baseline, template for LEDPs, indicators, monitoring tools, oversight mechanism, etc.)

- Support the European Commission (EC) and Partner Countries’ (PC) authorities to fine-tune the target definition and process of the M4EG initiative

- Ensure buying in and ownership of all actors to guarantee the maximum sustainability of M4EG in the region by engaging with various stakeholders, such as LAs associations, business associations, SMEs, education institutions, etc.

- Establish synergies with Covenant of Mayors (COM) in the field of energy efficiency/climate and other major initiatives

- Raise awareness of, and promote sign up to and implementation of, the M4EG

- Assist the cities in the implementation of their LEDPs, thus leading to sustainable economic growth for the municipalities

The central office of the project is established in Tbilisi which functions as a central secretariat for M4EG in the region and covers the countries targeted by this project.

The project will contribute to: partnership of the M4EG members, development of local investment projects, and supporting cities to move to more accountable, transparent and business-oriented local administration systems.

Background information:

With the purpose of overcoming a number of obstacles, in order to unlock the development potential of local authorities (LAs), the European Commission reaffirms the importance of LAs in partner countries in achieving development objectives. It therefore proposes more strategic engagement for their empowerment.

On the basis of the outcomes of the “Structured Dialogue on the involvement of Civil Society Organisations (CSOs) and LAs in EU Development Cooperation”, the European Commission Communication Agenda for Change recognises both actors as key players in its two pillars. It calls for strengthened "links with civil society organisations, social partners and LAs, through regular dialogue and use of best practices", in particular to “support the emergence of a local civil society which can effectively contribute to dialogue with public authorities and to oversee public authorities' work", and to “consider ways of mobilising LAs’ expertise, e.g. through networks of excellence or twinning exercises”. It also highlights the value of multi-actor partnerships including public actors, civil society, the private sector and local communities.

EU Urban Agenda, the EaP Municipal Development Flagship and the European Neighbourhood Instrument (ENI) Multiannual Indicative Programme (MIP) 2014-2017 include the development and empowerment of local authorities as a priority.

In addition, Agreements on a Deep and Comprehensive Free Trade Area (DCFTA) have been concluded with Ukraine, the Republic of Moldova and Georgia as part of the Association Agreements (AAs). It is important to increase the visibility and awareness among the business population of the impact and opportunities deriving from the DCFTA. Though information may be available in the capital cities of these nations, it is less accessible in smaller cities, towns and remote areas. One of the purposes of the Mayors for Economic Growth (M4EG) initiative is also to support municipalities in providing services to companies in cooperation with local BSOs to understand and benefit from the requirements and opportunities deriving from the DCFTA.

Follow the links below for related projects:

Support to the Center for Analysis and Communication of Economic Reforms under the President of the Republic of Azerbaijan in Legislative, Institutional and Economic Reforms in the Fiscal Sector

Support to Policy Dialogue, Coordination and Reforms in Neighbourhood Investment Facility (NIF) Related Sectors in Armenia

Support to Public Finance Policy Reform (PFM)

Partnership for Budget Transparency: Civil Society Oversight of Public Spending

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

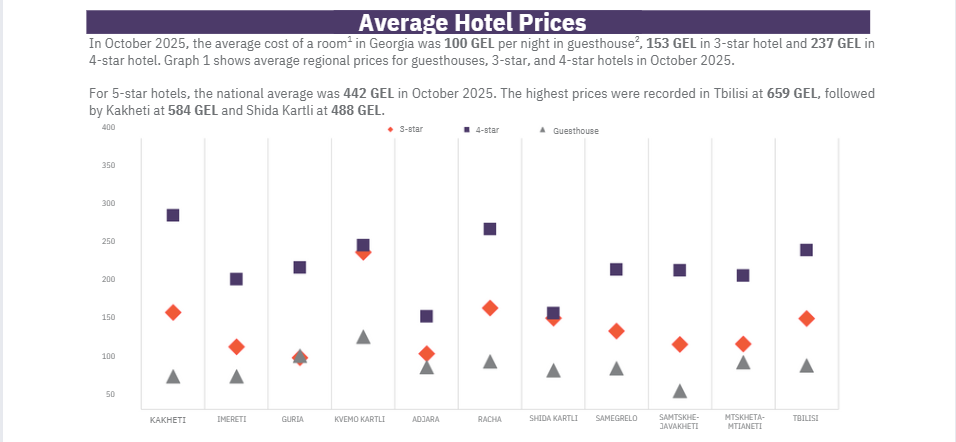

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.