Projects

Analyses of Tax Dispute Cases

Project Description:

The objective of this project is to analyze tax dispute cases, particularly those resulting from tax audit reports, dealt with by the Revenue Service Dispute Resolution Department, Ministry of Finance’s (MoF) Dispute Appeal Council and the Court. It also aims to identify the most frequently disputed areas of the tax legislation and to analyze whether the justifications of decisions across the relevant bodies are consistent. In addition it seeks to develop recommendations on how to address the identified deficiencies in both legislation and practice (including dispute resolution practice).

The tax dispute resolution system within the MoF consists of two tiers. It starts with the submission of a complaint to the Revenue Service Dispute Resolution Department. In the event of an unsatisfactory decision, the taxpayer has the right to lodge an appeal to the next tier – the Tax Appeal Council under the MoF.

The number of tax disputes, including appeals to the Court is increasing every year (1340 registered cases within the MoF system in 2012; 1875 in 2013; 1940 in 2014). On the one hand, the dispute resolution system has become overloaded resulting in delays, and on the other hand the taxpayers spend significant resources (time and finances) on disputes which could potentially be avoided.

Due to the large number of decisions, the MoF has never conducted a qualitative analysis to identify the gaps in the tax legislation and to recommend improvements. The MoF publishes the Tax Appeal Council’s Annual Reports on its website which are purely quantitative analyses including only the number of registered applications, hearings, disputes, decisions and the list of disputed topics. Meanwhile, the court decisions are seldom analyzed except for a limited number of cases considered by the Supreme Court. The most complex disputes usually relate to tax audit decisions.

In order to facilitate in-depth analysis of tax dispute cases, PMCG is conducting the following activities:

a. Screen tax dispute cases (registered in 2014 or after) in order to identify those, that:

- Have been considered by the Revenue Service Dispute Resolution Department, the MoF’s Tax Appeal Council and the courts

- Relate to tax audit decisions

- Remain relevant in light of the planned changes to the Corporate Income Tax (CIT)

b. Conduct in-depth analysis of selected tax dispute cases (up to 300 cases in total) to:

- Identify most frequently disputed provisions, concepts and areas of tax legislation

- Analyze whether the justifications of decisions across the relevant bodies of dispute resolution are consistent

c. Suggest recommendations on:

- Necessary amendments to the Tax Code

- Necessary secondary tax legislation (public rulings, etc.) to support interpretation of ambiguous provisions of primary legislation

- Improving the tax administration practice including the dispute resolution practice

Background Information:

Governing for Growth in Georgia (G4G) is a five-year multi-million dollar USAID project designed to support the Georgian government to create a better enabling environment in which legal and regulatory reforms are fairly and transparently conceived, implemented and enforced through consultative dialogue.

One of the major areas of reform supported by G4G in the energy sector of Georgia is the introduction of the Electricity Trading Mechanism (ETM) to enable competitive electricity trading in the domestic and export (primarily Turkish) markets. The ETM will enable the simultaneous foreign trade of electricity as opposed to the one-directional transactions that are currently the norm. The new ETM system is expected to be launched in 2019.

Follow the links below for more detailed information:

Governing for Growth in Georgia (G4G)

Assessment of Customs Procedures for Cross-Border Electricity Trading

Good Governance Fund

Support to Public Finance Policy Reform (PFM)

Support to Approximation of Georgian VAT Rules with EU VAT Legislation

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

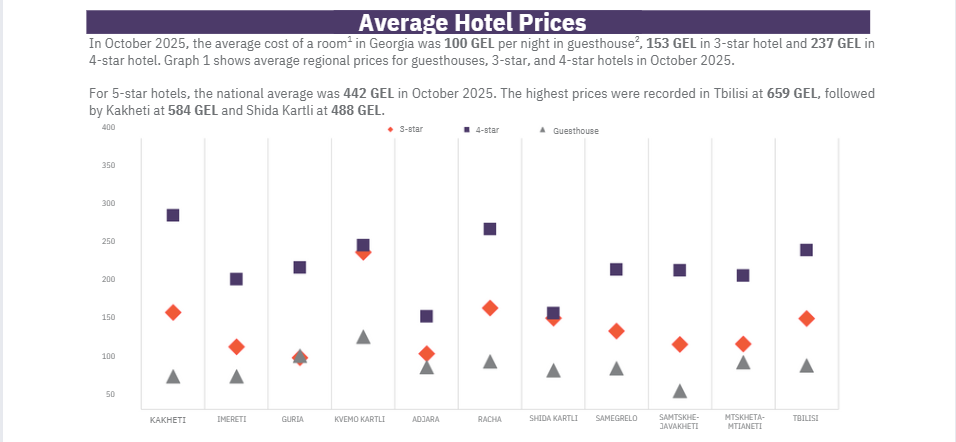

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.