Projects

Identification and Prioritization of National Level Government to Business (G2B) Services Regulatory Reforms

In 2016, the Government of the Islamic Republic of Afghanistan (GoIRA) formed the ‘Displacement and Returnee Executive Committee’ (DiREC) to provide policy and operational support in the development of a policy framework as well as in the coordination of humanitarian and development efforts. The concept of the EZ-Kar project was derived from the interlinked DiREC strategy and corresponding multi-ministerial technical working groups - which pursued a programmatic approach. The project was formally agreed upon by the World Bank and the GoIRA in December 2018. The project’s development objective is to make the environment more enabling for economic opportunities in cities where there are high influxes of displaced people. The Ez-Kar project has five components to be implemented by implementing agencies: regional and national integration of displaced persons by the Ministry of Foreign Affairs (MoFA); short-term employment opportunities, reforms, market-enabling infrastructure, and municipal-level regulatory reforms in 12 cities by the Independent Directorate of Local Governance (IDLG); priority investments in 4 provincial capital cities by the IDLG; market-enabling infrastructure and regulatory reforms for Kabul city by Kabul Municipality (KM); and project coordination, red carpet and national-level regulatory reform by the Ministry of Economy (MoEc).

The aim of this project is to support the MoEc in the identification and prioritization of National Level Government to Business (G2B) Services Regulatory Reforms.

PMCG, with regard to the National Level Government to Business (G2B) Services Related Regulatory Reforms, conducts the following:

- G2B Regulatory Framework Assessment / Gap Analysis

- compiling a list of all laws, regulations, guidelines, policies, and other legal documents related to all G2B services in Afghanistan;

- studying their actual feasibility and requirements versus actual implementation, as well as average timelines for the various steps, and number of steps needed for each such service;

- conducting comparative research;

- obtaining and analyzing international best practices and comparing them with ideal or desired scenarios for similar services in other developing countries; and

- providing practical recommendations.

- Preparation of a National-level G2B Regulatory Reform Action Plan

- preparing an action plan jointly with the MoEc EZ-Kar PIU’s program team on what measures may (a) be undertaken by MoEc, and (b) be proposed to other line ministries or other key stakeholders, to streamline and simplify the process; and

- this action plan will seek to bring both efficiency and effectiveness into the various services, by both reducing the number and complexity of the steps and days being taken to implement them.

- Technical Assistance to the MoEc and the Relevant Institutions in Implementing the Action Plan

- working with the relevant institutions and the MoEc EZ-Kar PIU’s Program Team in implementing the national-level G2B regulatory reform action plan, which includes but is not limited to preparing proposals to amend, consolidate and develop related policies, laws, regulations and procedures, as well as restructuring government agencies/units for G2B services, automation, capacity building, etc.

In terms of construction permit regulatory reforms at national level, PMCG conducts:

- Construction Permit Regulatory Reform Implementation

- working with the MoEc and relevant institutions concerned in the actual implementation of the approved construction permits reform action plan.

- the implementation will include introducing a harmonized mechanism for the issuance of CP and a reduction in the overall time and steps (and ultimately costs) to obtain construction permits at the national level through preparing proposals on amending, consolidating and developing related laws, regulations, procedures, etc.

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

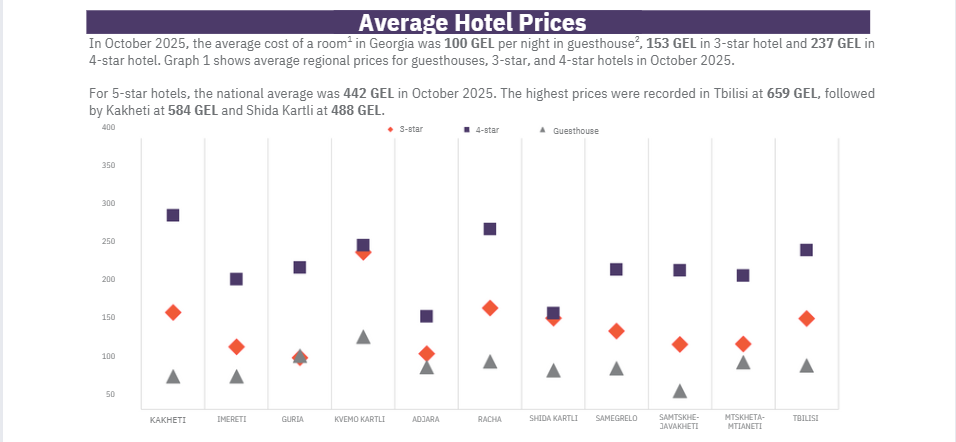

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.