Projects

Support to PFM Reform in Egypt

In recent years, Egypt has succeeded in establishing a macro-fiscal environment, during which time good progress has been made on budget consolidation, leading to more sustainable public finances.

Nonetheless, the COVID-19 pandemic and containing measures taken by the Egyptian government will have long-lasting consequences including fiscal consolidation and macroeconomic aggregates. The pandemic, in addition, will exacerbate the already high level of public debt and large financing needs in the country. The EU Delegation is providing extensive support to the Government of Egypt through different forms of aid. The provision of development cooperation requires regular monitoring through government policies and legislation in different domains of the fiscal situation (general and sector budget analysis, budget execution, budget transparency, budget comprehensiveness, revenue analysis, etc.) of public financial management (PFM) and of the macro-economic environment.

During 2019, the EU has deepened its PFM dialogue with the Ministry of Finance (MoF)of Egypt , which culminated with the finalization of a comprehensive package supporting public administration reform and PFM. The PFM component is expected to stimulate the implementation of medium-term PFM priorities, which requires, inter alia, the design of a program-based budget, the full architecture and governance of risk management, institutional capacity-building, and continued policy dialogue. This action, which is part of the Annual Action Plan 2019, will be launched in the near future. Other key international organizations and donors active in supporting the PFM reform process in Egypt are the IMF, IMF METAC, the World Bank, USAID, OECD, and OECD-SIGMA.

In this context, the overall objective of the assignment is to contribute to the PFM reform process undertaken by the Government and MoF of Egypt, taking into account the post-COVID fiscal context.

Specifically, the project is to support the Government of Egypt, and specifically the MoF and its affiliated entities in the path towards further reforming the PFM system as well as to support the EU Delegation on: (i) assessing the PFM reform in Egypt; (ii) updating the PFM annual monitoring reports; and (iii) drafting the Terms of Reference (ToR) of an upcoming EU action supporting PFM.

Inception Phase

- Documentation and preliminary analysis;

- Kick-off meeting with the EU Delegation and the MoF allowing full understanding of the expectations regarding the outputs, scope, and limitations of the project;

- Identification of needs;

- Definition of indicators for the project performance, in agreement with the EUD Project Manager; and

- Draft inception report.

Component 1:

- Regular meetings and consultations with the management of the MoF and affiliated entities to agree on the scope of assistance and specific activities;

- Inform beneficiary institutions about the instruments of PFM reform, and stimulate demand for assistance in line with the priority areas of the project and the ongoing PFM reform;

- Coaching of the management and the staff of the beneficiary institutions to develop ideas and formulate their needs according to the standards and criteria required by the EU project;

- Trainings of the management and the staff of the MoF and affiliated entities in government-wide PFM frameworks and systems which may include MTBF, program budgeting, international taxation, public procurement and audit as potential areas for further cooperation; and

- Technical and legal advice to the MoF and its affiliated entities to support implementation of the PFM reform.

Component 2:

- Assistance to the EU Delegation in the process of budget support eligibility assessment;

- Preparation of the Terms of Reference for the upcoming technical assistance project financed by the EU;

- Assessment of the implementation of PFM reforms - updated PFM annual monitoring reports will be produced at the end of every calendar year;

- Assessment of post-COVID fiscal situation and PFM challenges (with policy recommendations);

- Facilitation of policy dialogue of the EU Delegation with the management of the MoF to support the PFM reform process; and

- Presentations and/or awareness sessions will be organized for the EU Delegation staff and other stakeholders on policy, budget, and PFM issues.

Reporting and Closing:

- Progress report, which will summarize all the activities implemented, any problems encountered, and mitigation measures taken as well as details on experts’ missions, analytical works done, summary notes on core technical and legal advice delivered and detailed information on training and capacity-building activities;

- Progress report produced every six months after the start of the project;

- Interim report with a description of the work and the outputs produced at the end of the first year;

- Draft final report: summary of all achievements and recommendations, drawing together the different strands of the work. The reports shall include: all of the results and outputs, recommendations for further EU interventions arising from the work, and all outputs prepared by the team members;

- Final report – after having received comments from the EU Delegation regarding the final report, the Team Leader will finalize the document and the full package with a final invoice and the financial report accompanied by the expenditure verification report will be submitted.

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

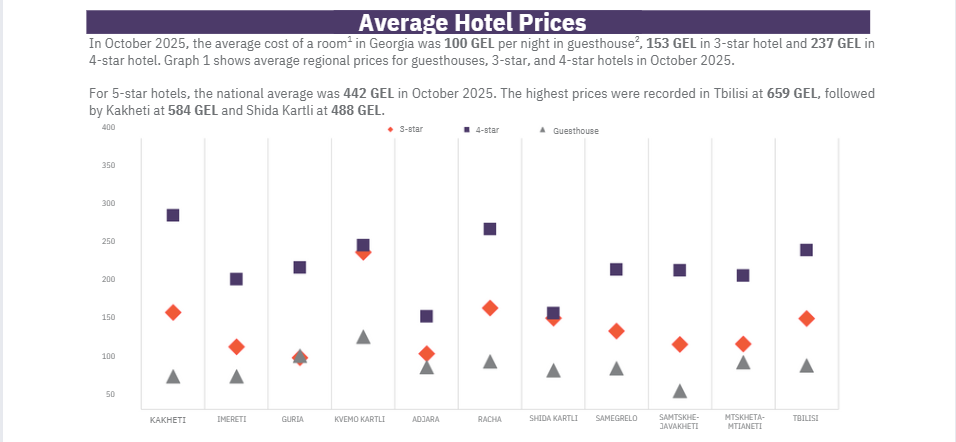

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.