Projects

Mongolia Business Plus Initiative (BPI)

PMCG, in cooperation with Chemonics International Inc., provided technical assistance to the Mongolia Business Plus Initiative (BPI), USAID project. The main goal of the project was to improve Mongolia’s business environment. PMCG’s participation focused on at least three indicator areas under the World Bank Doing Business survey, supporting Mongolia‘s aspirations to improve its business environment, legal framework, and institutional systems. The technical assistance provided was one of several instruments utilized by the BPI project to achieve significant results in the various areas of interventions under its three focus areas: Licensing and Permissive System; Tax System, and Customs Administration. Assistance from PMCG was based on the experience and successful reforms of certain countries in the regions of Eastern Europe and Central Asia, as well as Georgia.

The assistance was divided in three phases:

Phase I - In Mongolia – provided high level technical assistance to help BPI in bringing key policy makers in the public and private sectors toward a single vision for the country to eliminate legal and regulatory burdens to private sector development (i.e. red-tape), including improved electronic information sharing by government agencies, in preparation of the September National Competitiveness and Business Enabling Environment Forum 2012: Cutting Unnecessary ‘Red Tape.’ Additionally, support is provided in conducting technical analyses and review forecasts on proposed tax amendments and conducting first assessments on construction permits, including a path forward to foster significant improvement in this indicator within one year.

Phase II – In Georgia – Organized a Doing Business Study Tour for a key delegation of public and private sector representatives from Mongolia in the areas of trade facilitation – including risk management, paying taxes and construction permits.

Phase III – In Mongolia – Provided short-term specialized assistance in the area of paying taxes (including legal and regulatory reforms needed to significantly reduce the compliance costs for SME); trade facilitation (including full implementation of the customs risk management system); and construction permits.

More precisely, during the first phase PMCG implemented the following activities:

- Hold one-on-one policy dialogue meetings with at least 6 high level Mongolian government officials currently, or soon to be, in a position to influence policy decisions. The meetings will provide an opportunity to discuss how short-term reforms that are affordable, achievable, with high impact are important for Mongolia today. These meetings are essential for the upcoming country leadership to understand the justification and the urgency for the reforms at the present stage of Mongolia’s development. These meetings will also provide a good indication of who does and does not support the proposed reforms.

- Hold similar one-on-one meetings with at least 6 key representatives of the Mongolian business sector to familiarize them with the “Year One Business Enabling Environment Road Map” initiative to encourage private sector support for potential reforms. These meetings will aim to show the private sector what role they can play to support the new country leadership in fostering affordable, achievable and high impact reforms in the short term.

- Hold a press conference in collaboration with the Press Institute and the Economic Journalists Club on key highlights of the Georgian reforms, and their applicability to Mongolia’s current situation.

- Present experiences as a key architect of reforms in Georgia, which strengthened that country’s competitiveness and improved its business enabling environment, during the September National Competitiveness and Business Enabling Environment Forum.

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

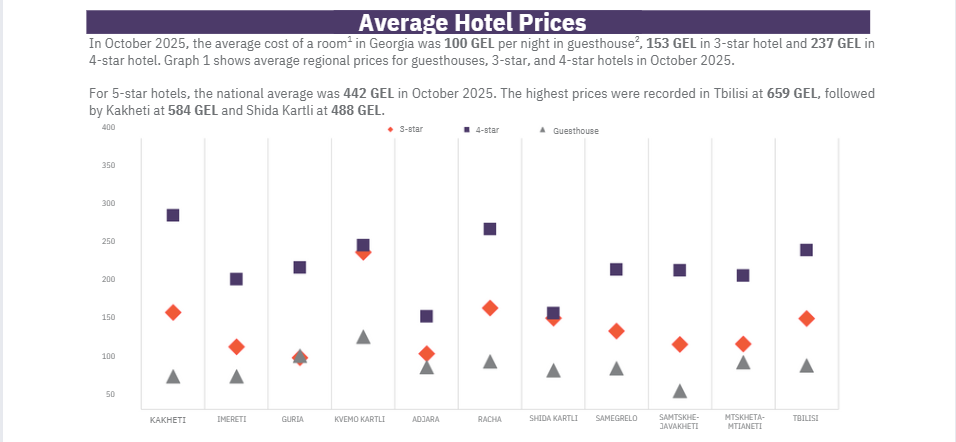

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.