Projects

Consultancy to Improve the Performance of Georgian National Communications Commission

Project Description:

PMCG has been contracted to assist the Georgian National Communications Commission (GNCC) in the process of its reorganization. The main objective of the project is to bring the GNCC’s organizational structure in line with the current circumstances, with internal and external factors as well as with the requirements of stakeholders.

The project activities cover five main directions:

1. Organizational Assessment

PMCG’s organizational development consultants will assess the current organizational structure of GNCC using cabinet research, in-depth interviews and focus groups and will analyze whether the latter meets the requirements of implementing the functions and powers defined by legislation in an effective, time-bound and cost-efficient way. At the same time, PMCG’s legal consultant will study the regulations of some of the commission’s departments and other legislative acts and evaluate their compliance and compatibility with the statutory mandate. In addition, PMCG’s HR team will conduct job analysis in order to define whether the current staff is capable of effectively carrying out the organization's objectives. If instances of any non-compliance with the qualification requirements are found, special recommendations will be developed.

2. Developing Organizational Structure

PMCG experts on HR management and organizational development will closely cooperate in order to evaluate the GNCC’s readiness for organizational changes and develop recommendations for further improvement of organizational structure and the regulatory framework. PMCG will develop the optimal organizational structure based on the results of job analysis; analyses of the regulations of the structural units of the commission; and review of the best practices of similar organizations.

Moreover, PMCG will offer the GNCC’s management the Business Solutions Package (BSP) based on the agreed organizational structure and assist the commission through the whole process of institutional transformation.

3. Developing Job Descriptions

PMCG’s HR team will arrange a number of focus groups and in-depth interviews in order to conduct thorough job analyses and develop the package of job descriptions corresponding to the agreed organizational structure.

4. Human Resource Management Policy

PMCG will provide consulting on recruiting process and also methodological support in refining the employee recruitment system so as to comply with the qualification requirements identified in the process of job analyses and the labor relations regulatory framework including labor reimbursement (compensation, benefits) policies which will also be taken into account while renewing the employee selection and recruiting system.

Based on the organizational assessment and organizational structure analyses, PMCG consultants will design and develop a human resource management (HRM) system and provide GNCC with policy advice about using HR resources effectively in order to achieve the commission’s mission and objectives.

5. Developing Key Performance Indicators

PMCG will assist the GNCC in the process of defining Key Performance Indicators (KPI) --quantifiable, specific measures of an organization’s performance. KPI is the essential element of Performance Monitoring and Evaluation System (PMES) which conducts a vital role in the process of transformation and improvement of the internal control system.

Follow the links below for more related information:

Review of the Government Payroll and Human Resource Management in Tajikistan as the Basis for the Conceptual Design for Integrated Payroll and Human Resource Management and Automation Project

Performance Solutions Package for Georgian State Electrosystem (GSE)

Institutional Performance Assessment Project of Georgian State Electrosystem (GSE)

Developing Manual for NASP on Bankruptcy, Liquidation and Merger of SOES

Streamline Merger, Bankruptcy and Liquidation Procedures of SOEs

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

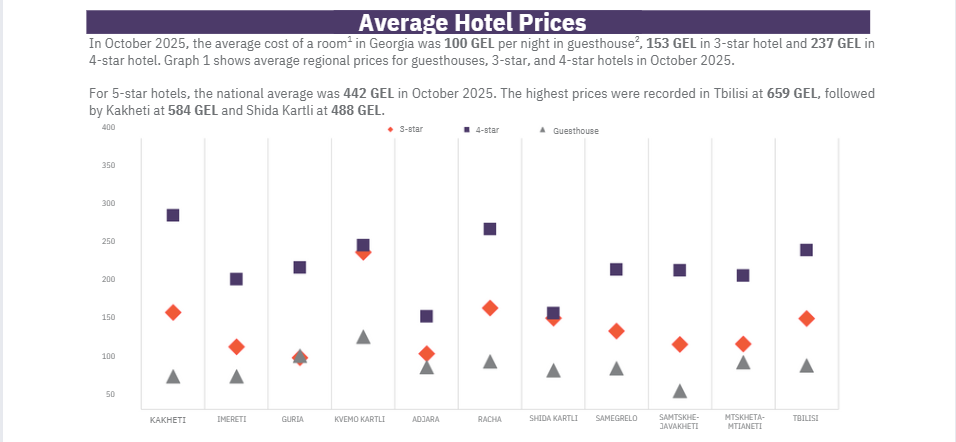

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.