Projects

Sharing Experience of Public-Private Dialogue in EU Integration Process for Moldova and Georgia

Project Description:

PMC Research is implementing the project entitled Sharing Experience of Public-Private Dialogue in EU Integration Process for Moldova and Georgia, which aims to assist Georgian and Moldovan businesses and governments to have a better understanding of the potential costs and benefits of the implementation of the DCFTA and of the need for effective coordination mechanisms in order to ensure the timely completion of the EU approximation process. The project envisages sharing the experience of Visegrad countries in developing a constructive public and private sector dialogue while harmonizing legislation and standards with those of the EU.

The project consists of two major workshops in Tbilisi and Chisinau which will gather relevant stakeholders and business associations to discuss related developments, challenges and to agree on the measures to be taken in the upcoming period in order to fully benefit from the opportunities the DCFTA offers to these countries. Both workshops are aimed at the creation of an established and sustainable network among representatives of business associations in Georgia, Moldova and Visegrad countries to deepen cooperation.

The project will be beneficial for a given EaP country and the region. It will facilitate the exchange of lessons learned by businesses and public authorities in the Visegrad countries during the accession/integration processes. Moreover, businesses will be better informed as to how to survive the transition process and how to increase their competitiveness. Furthermore, Georgian and Moldovan businesses will have access to developed networks with counterpart structures in the Visegrad countries that will help to realize significant outcomes in the future.

The project targets a broad range of groups:

- Business Associations in Georgia, Moldova, Poland, Slovakia, Czech Republic and Hungary

- Entrepreneurship Development Agency of Georgia

- Trade Unions (food producers, industry representatives mainly from Georgia and Moldova but also from Poland, Poland, Slovakia, Czech Republic and Hungary)

- EU-Georgia Business Council

- Chamber of Commerce and Industry of Georgia and Moldova

- International Chamber of Commerce in Georgia and Moldova

- Ministry of Economy and Sustainable Development of Georgia and Ministry of Economy of Moldova

- Ministry of Foreign Affairs and European Integration of Moldova

- Office of the State Minister of Georgia in European and Euro-Atlantic Integration

PMC Research will provide services for the following activities:

- 3-day workshop in Tbilisi

- PMC RC will be responsible for identification of participants who will be: key Georgian stakeholders (up to 15 representatives), 6 experts/practitioners from Visegrad countries (PO, CZ, SLO, HU) and 5 representatives of Moldovan stakeholders

- 3-day workshop in Chisinau

- PMCG, together with partners, will be responsible for identification of participants who will be: key Moldovan stakeholders (up to 15 representatives), 6 experts/practitioners from Visegrad countries (PO, CZ, SLO, HU) and 5 representatives of Georgian stakeholders

- In order to share information, raise awareness and make this process more productive, PMCG will create a project webpage and distribute information about the project and its results

Background information:

Georgia and Moldova have recently signed and ratified Association Agreements with the EU, including Deep and Comprehensive Free Trade Agreements (DCFTA). The signing of the Agreements will have substantial implications for Georgian and Moldovan businesses:

- The Georgian and Moldovan governments have agreed to harmonize their legislation with that of the Single European Market, notably with respect to standards, metrology, accreditation, competition, market surveillance, food safety, and intellectual property, and to reduce technical and administrative barriers to entry into the domestic markets. The adoption and enforcement of harmonized legislation will impact upon the cost of doing business for Georgian and Moldovan businesses, and the removal of technical and administrative barriers will expose them to greater competition in their domestic markets from EU-based companies. It is imperative that the business associations in Georgia and Moldova are able to communicate with their respective governments and enable efficient and effective participation in the legal drafting processes in order to ensure that their members’ interests are protected.

- Conversely, the signature of the Agreements offers substantial opportunities for Georgian and Moldovan businesses to enter the Single European Market. However, in order to maximize the benefits deriving from the Association Agreement, Georgian and Moldovan businesses will in all probability need to develop partnerships with EU companies, participate in their marketing and distribution chains, and learn from their knowledge of the markets.

At present, the business communities in both Georgia and Moldova are ill-equipped to meet these challenges. Local business associations have limited impact on the policy-making and legal-drafting processes, their lobbying capacity is also very low, and the coordination between the associations and the government is limited. The structures and processes of social dialogue are still embryonic. Moreover, Georgian and Moldovan businesses have little experience of entering and exploiting European markets: the previous trade agreements were quota-based, and few companies could match the required levels of quality and safety.

The Visegrad countries have highly relevant experience when it comes to coordination between business and government during the Association/Accession process, and have successfully integrated into the Single European Market. The planned workshops in Tbilisi and Chisinau which will bring together representatives of Chambers of Commerce and Industry, social partner organizations and relevant practitioners from the Visegrad countries and their counterparts in Georgia and Moldova.

Follow the links below for more detailed information:

Sharing Georgia’s Experience of Successful Reforms with Belarus

Sharing Experience of Georgian Reforms and Visegrad Countries' EU Economic Integration for Albania and Kosovo

Support to Approximation of Georgian VAT Rules with EU VAT Legislation

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

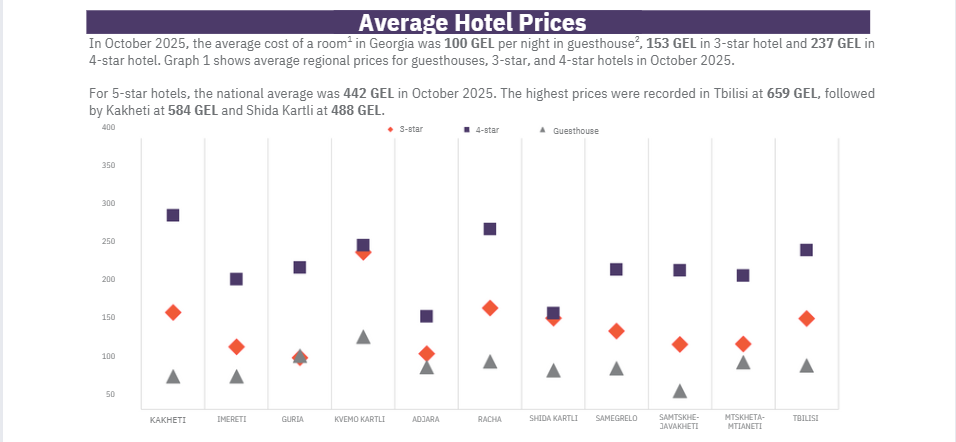

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.