Projects

Revenue Generation for Governance and Growth (RG3)

Project Description:

The purpose of the project is to increase the capacity of targeted government institutions of Liberia, particularly the Ministry of Finance and Development Planning (MFDP) and the Liberia Revenue Authority (LRA) to improve domestic revenue mobilization in the country.

The project led by DAI International is focused on supporting the MFDP to develop the capacity to formulate sound, predictable, and fair revenue policies. In addition, it also seeks to support the LRA to enhance its ability to effectively, efficiently, and transparently implement those policies and carry out its revenue collection mandate.

The project will also involve collaboration with the Government, private sector, and civil society to strengthen dialogues, and to raise awareness and engagement about taxes and their benefits with an aim to build tax morale, increase voluntary compliance, and foster greater trust between taxpayers and the Government.

PMCG is working with the MFDP and LRA to create a policy environment that is predictable, transparent, fair and conducive to improved revenue mobilization.

In this regard, PMCG will conduct the following activities:

- Assist MFDP and LRA to enhance revenue forecasting

- Assist MFDP to review the current tax regime for adequacy and support institutionalization of processes for the development and drafting of laws and regulations where appropriate

- Support analysis, consultation, and advocacy toward the introduction of VAT and the planning, coordination, and execution of VAT implementation

- Assist MFDP and LRA in the preparation of specialized analysis, including tax expenditure analysis, impact analysis and data analysis

- Increase the capacity of MFDP and LRA to review, analyze, and provide recommendations on the fiscal terms of concessions and other investment agreements

In addition, PMCG will support the LRA to improve the efficiency, integrity, and transparency of revenue administration via the following specific activities:

- Assist the LRA to expand taxpayer registration, including that of individuals (non-corporate taxpayers)

- Support planning and roll out of tax and customs “e-services,” such as e-filing, e-payment, and mobile money, with an aim to reduce compliance burdens and improve revenue collection

- Assist LRA leadership and build Professional Ethics Department (PED) capacity to institute a strategy, controls, and measures to promote ethical conduct, to investigate and address misconduct, and to improve LRA staff integrity

- Assist the LRA to develop and roll out competency-based tax and customs training programs, including in taxpayer services, tax audit, collections/debt management, IT, management, and other areas

- Assist the LRA, BOTA, and the judiciary, as appropriate, to develop capacity to objectively, transparently, and efficiently manage objections and appeals as well as cases referred to the Liberian courts

- Support the LRA in the development and implementation of a communications strategy, including informational guides, FAQs, and other user-friendly materials to educate and guide the public on tax issues

Follow the links below for related projects:

The Final Performance Evaluation of USAID Iraq Administrative Reform Project (TARABOT)

Competitive Trade and Jobs (CTJ) Activity in Central Asia

Support to the Center for Analysis and Communication of Economic Reforms under the President of the Republic of Azerbaijan in Legislative, Institutional and Economic Reforms in the Fiscal Sector

Improving Deregulation and Fiscal Efficiency in Albania

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

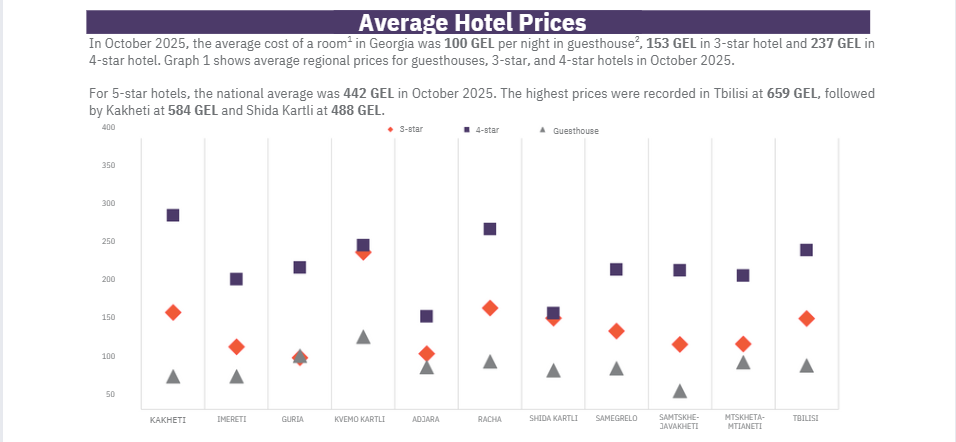

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.